Inversión

Ofrece la infraestructura necesaria para operar Multiempresa.

Utiliza la inversión existente en software y hardware reduciendo costos de implementación y sin generar gastos adicionales.

Tamaño del texto:

Napse Vtol

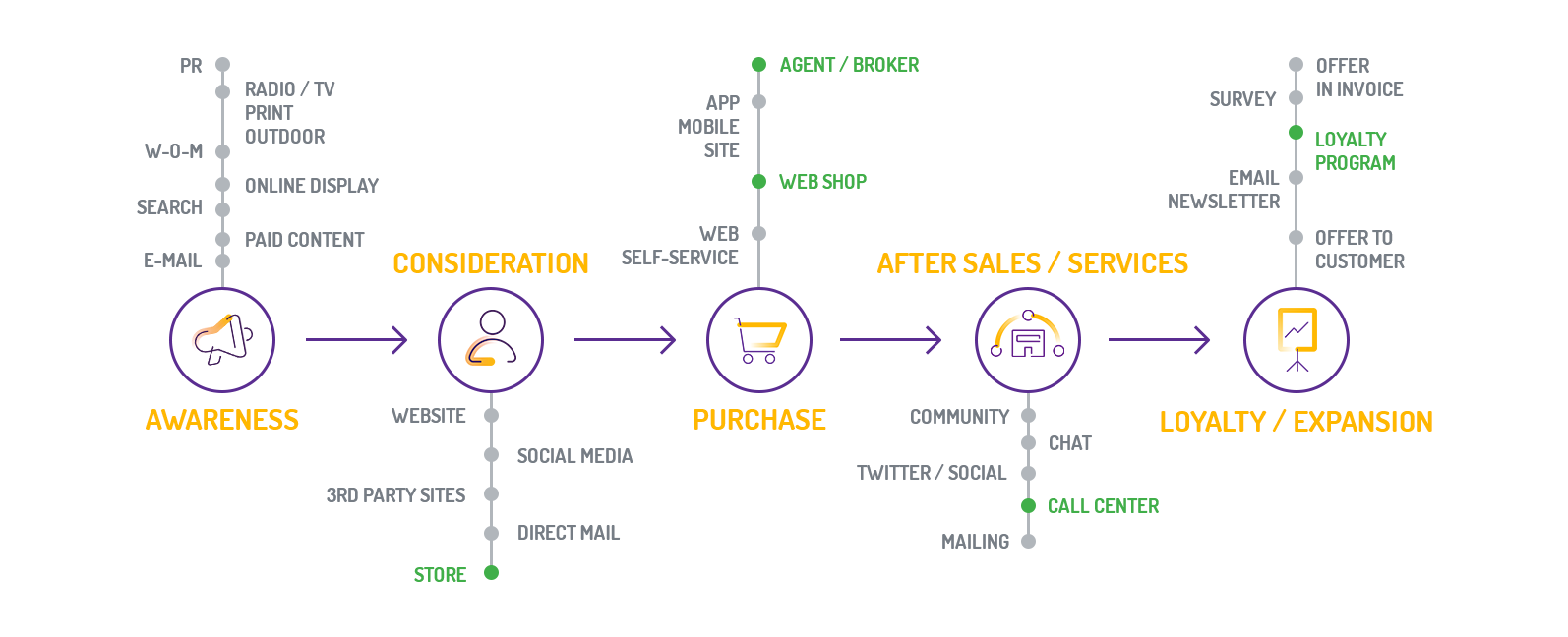

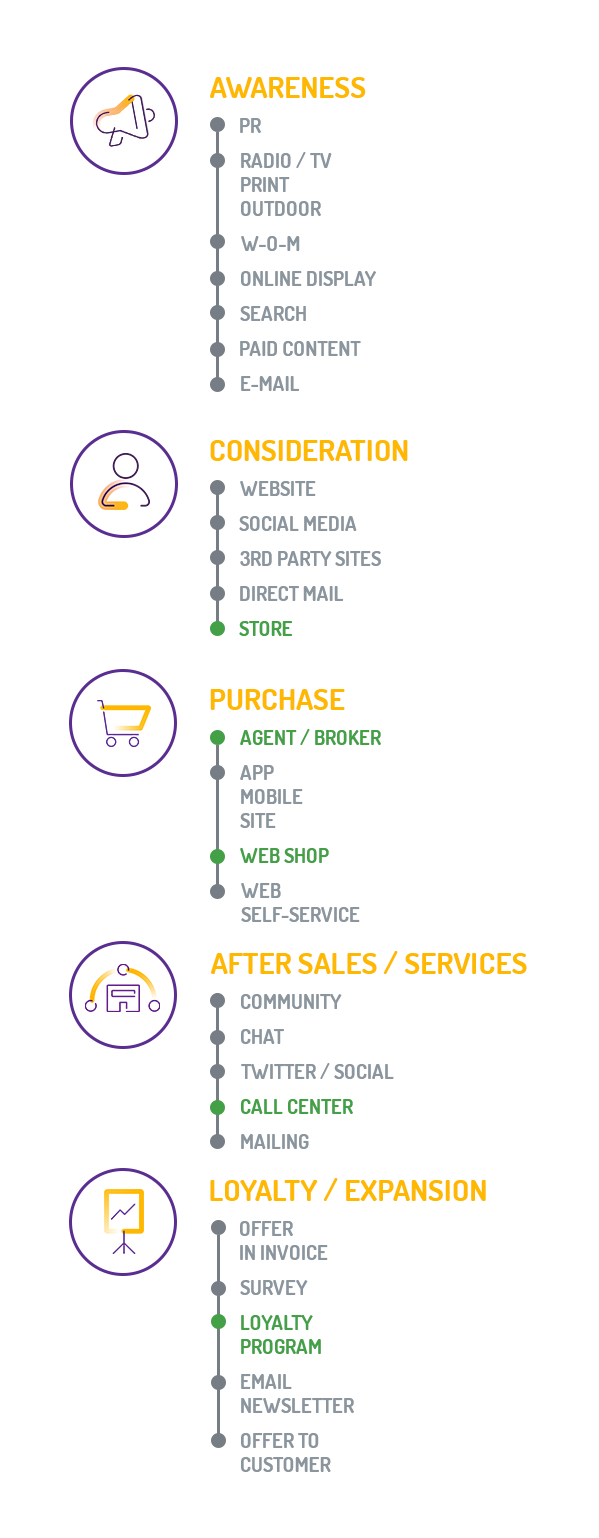

Napse vTOL optimiza la experiencia de pago en todos los canales de venta, contribuye a no perder ventas por demoras y dificultades en el momento del pago. Su diseño multiempresa permite hacer más eficiente la gestión de medios de pago en grupos empresariales, operaciones internacionales y múltiples filiales.

Ofrece la infraestructura necesaria para operar Multiempresa.

Utiliza la inversión existente en software y hardware reduciendo costos de implementación y sin generar gastos adicionales.

Realiza Transacciones en segundos.

Procesa simultáneamente ventas con tarjeta en diferentes cajas. Integra al punto de venta mediante librerías.

Se basa en diversos lenguajes (.NET, Java) compatibles con otros sistemas.

Los datos de las ventas son registrados automáticamente eliminando la posibilidad de error humano.

Es EMV Compliant y PCI. Posee una Arquitectura preparada para ambientes de alta disponibilidad y contiene un módulo antifraude.

Napse Vtol es una solución que integra de manera completa los medios de pago electrónicos como links de pago, billeteras electrónicas, entre otros, y los tradicionales como las tarjetas bancarias dentro un mismo sistema de gestión de puntos de ventas bajo la homologación de los principales proveedores de servicios de Latinoamérica.

Quiero saber másNapse vTol permite realizar transacciones bancarias desde cualquier medio de acceso:

• mensajería corresponsal bancaria

• venta de TA

• pago de servicios

• membresías

• PIN pads certificados.

Puede hacer consultas en tiempo real de todas las transacciones realizadas por medio de VTOL/Consola de administración web.

Quiero saber másPara mejorar su experiencia y garantizar el funcionamiento del sitio,

instale un navegador moderno.

Recomendamos Google Chrome. Clic aqui para descargar.

Nosso website faz uso de cookies. Para mais informações, acesse nossa Política de Cookies.